Automatic VAT Verification for Customers and Vendors

What is this feature for?

This feature enables automatic VAT Status verification for Customers and Vendors in the Microsoft Dynamics 365 Business Central system.

When a Customer No. / Vendor No. field is filled in on a document, the system automatically checks the VAT Status Code.

What benefits do you get?

✅ Automatic VAT status verification for business partners

✅ Assurance that system data matches the VAT registry

✅ Time savings through automation

How to enable the feature?

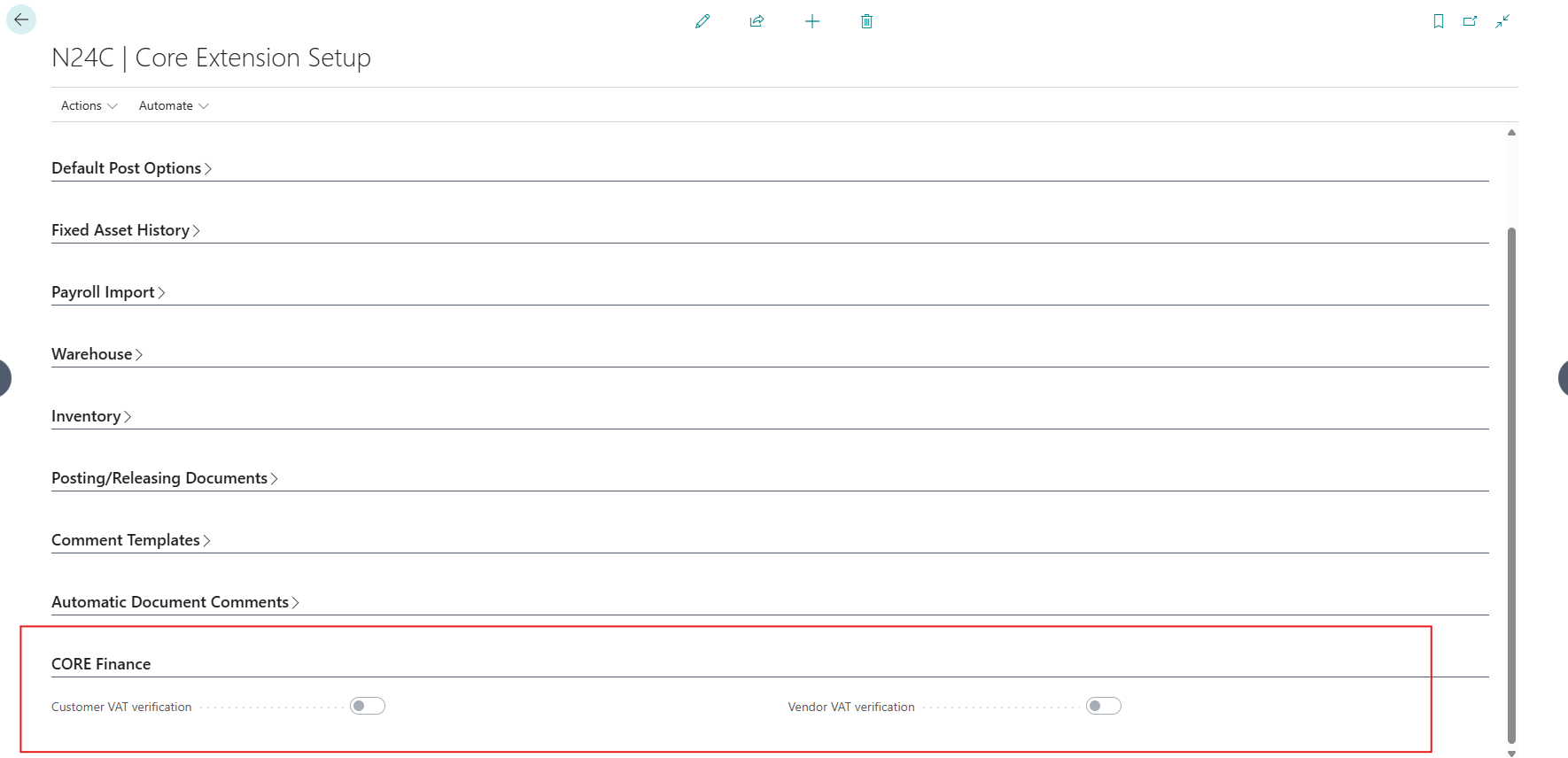

- Go to CORE Extension Setup page

- In the CORE Finance section, find the Customer VAT Verification and Vendor VAT Verification fields

- Check the checkbox to activate the feature

📌 Note: For the functionality to work correctly, business partners must have their Country/Region Code set to PL

How does it work in practice?

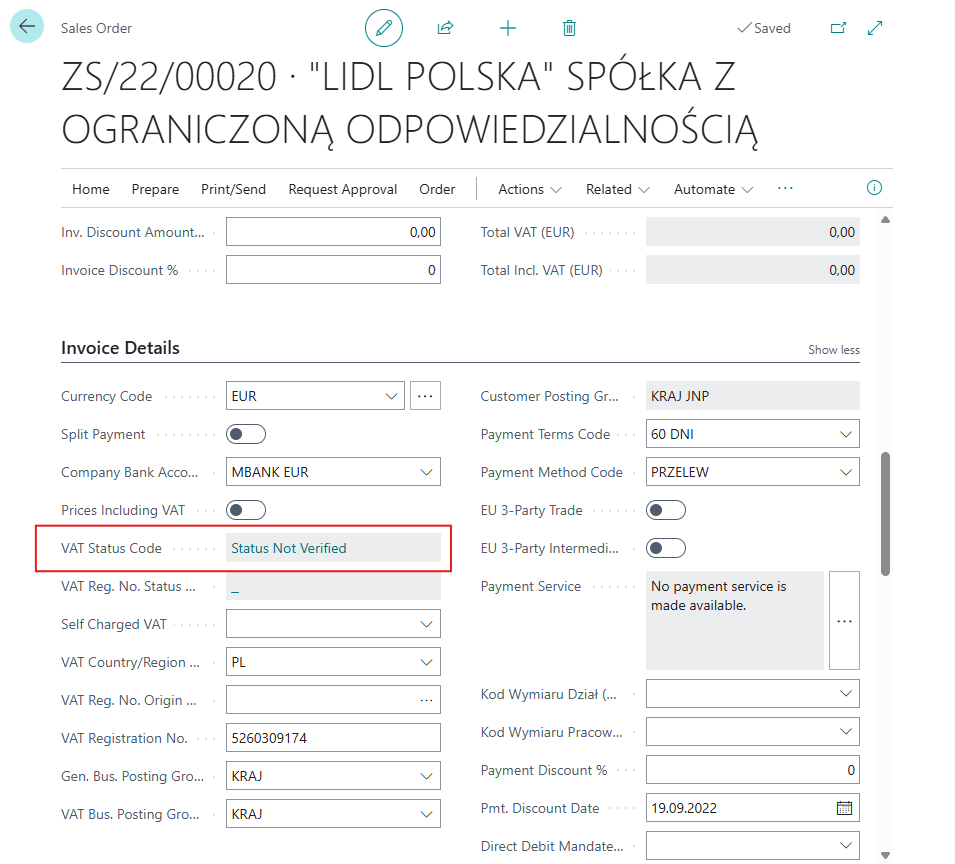

Verification on documents

After filling in the Customer No. / Vendor No. field:

- The system checks if an entry has already been created in VAT Registration Log for that day

- If not – it creates a new record

- Then sets the appropriate VAT Status Code

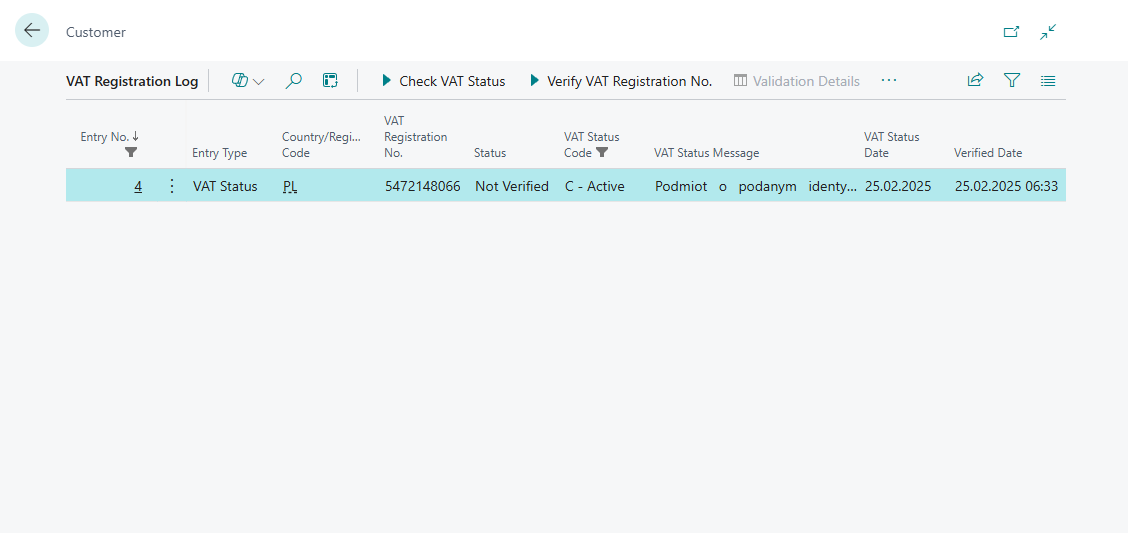

View logs

When clicking on the VAT Status Code field:

- The VAT Registration Log page opens

- You can view the history of VAT status checks

📎 Full VAT verification functionality documentation:

Polish Localization Documentation